Causes that will have an effects on XAUUSD (GOLD)

- Yesterday Gold price negatively closed by 22.10 USD Per Trou Ounce, The Gold price retreat could be attributed to the market’s pricing of a delayed and slower policy pivot by the Fed, as affirmed by Fed Chair Jerome Powell on Tuesday.

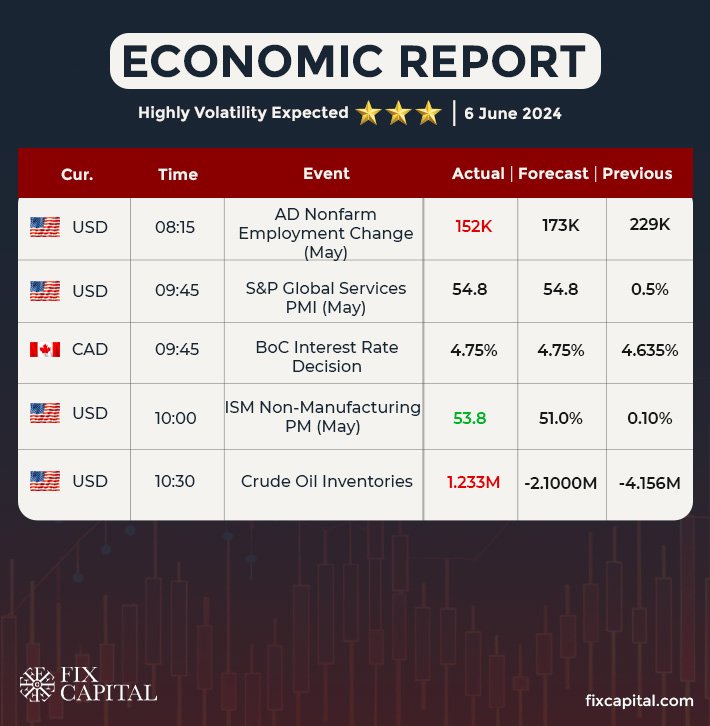

- Today we have important Economic report for USA which is Initial Jobless Claims, It is expected that outcome will be greater than last time, if it turn out as its expect, then this forecast will be positive for Gold price.

- Today we have important Economic report for USA which is Philadelphia Fed Manufacturing Index (Apr) , It is expected that outcome will be lesser than last time, if it turn out as its expect, then this forecast will be positive for Gold price

- Today SPDR Gold Shares sold out gold 1.44 Tonnes and currently holding total gold of 827.85 Tonnes

Weekly Gold Forecast Direction : Sideways Up

- New York gold futures closed negative on Wednesday. This is because investors are worried that the Federal Reserve (Fed) may delay the time to cut interest rates this year.

- Analysts from Blue Line Futures say gold prices continue to hover near record highs. This is because the geopolitical tension situation is still a factor supporting the market and it is expected that if the situation becomes more tense It may cause the price of gold to rise to the level of 2,500 dollars.

- Federal Reserve Vice Chairman Philip Jefferson said “it would be appropriate for the Fed to maintain its current tight policy position for a long time” if inflation does not slow. down as expected

- Yesterday’s gold price opened at $2380 and then gold price got sold hard and drop down to the level of $2354 before rising to close at $2361.

·

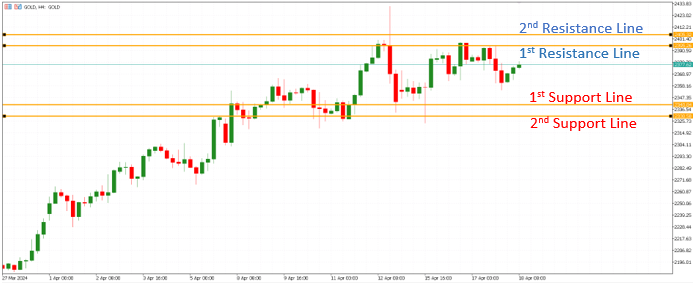

XAU/USD Technical Overview

Yesterday, the gold price closed at negative 22.10 dollars. Gold prices were sold off as investors were worried that the Federal Reserve (Fed) might delay the time to cut interest rates this year (-) even though gold prices had selling pressure. But there is buying power to push up the price when the price weakens. It is recommended that traders consider opening Buy at the level of $2,353 – $2,345 to make short-term profits and cut losses at the level of $2,324 (+). While the overall direction of gold is now moving sideways up, Today it is expected that gold prices will run within the support level of $2,340 and $2,330, with resistance levels at $2,395 and $2,405.

Technical View

1st Support Line 2340 1st Resistance Line 2395

2nd Support Line 2330 2nd Resistance Line 2405

Note: The above information may be inaccurate. Investors should not use this as a basis for deciding to place a trade.