Causes that will have an effects on XAUUSD (GOLD)

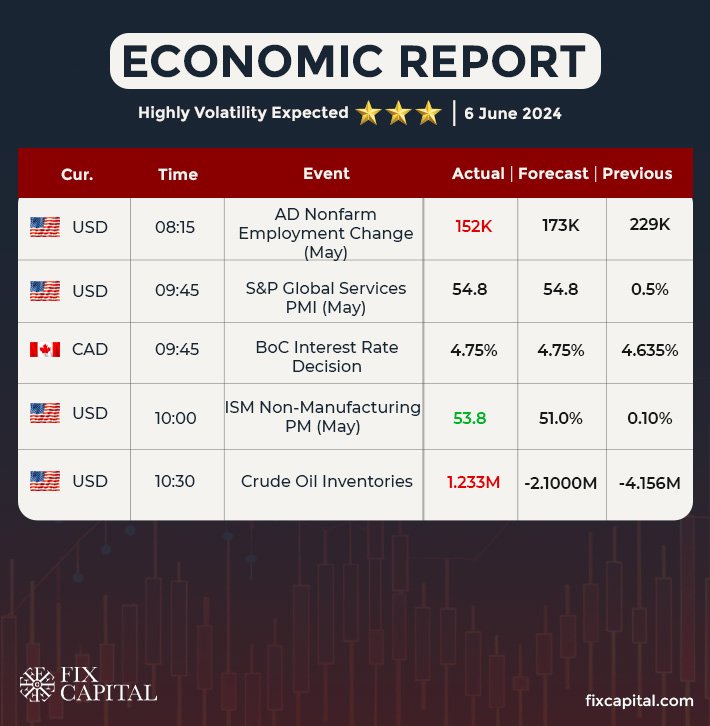

- The gold price (XAU/USD) gains traction amid the weaker US Dollar (USD) on Thursday. The recent Consumer Price Index (CPI) report showed inflation in the US slowed in April, prompting market players to increase their bets on the US Federal Reserve (Fed) rate cuts this year. A lower interest rate might benefit the yellow metal, as it means the borrowing cost of investing in gold decreases.

- Gold traders will focus on US Building Permits, Housing Starts, the weekly Initial Jobless Claims, the Philly Fed Manufacturing Index, and Industrial Production on Thursday. Also, the Fed’s Barr, Harker, Mester, and Bostic are scheduled to speak on Thursday. Nonetheless, the hawkish comments from the Fed’s officials might boost the US Dollar (USD) and cap the precious metal’s upside in the near term.

Weekly Gold Forecast Direction : Sideways Up

- Interest rate cuts to boost Gold

- Gold should benefit from negative real yields in Q2

- US recession risks to keep Gold well in demand

- One of the warning signs of a collapsing currency would be a spike in Gold prices

XAU/USD Technical Overview

The gold price edges higher on the day. Technically, the yellow metal has formed an ascending trend channel since May 2. The yellow metal maintains its positive stance unchanged on the four-hour chart as XAU/USD holds above the 100-period Exponential Moving Averages (EMA). The Relative Strength Index (RSI) stands in bullish territory around 72. The first upside barrier will emerge near the upper boundary of the ascending trend channel and psychological level of $2,400. A bullish breakout above this level will expose $2,432 (all-time high) en route to $2,500 (round figure).

On the downside, a breach of the lower limit of the ascending trend channel of $2,345 will pave the way to $2,334 (100-period EMA), followed by $2,300 (psychological mark).

Technical View

1st Support Line 2360 1st Resistance Line 2420

2nd Support Line 2350 2nd Resistance Line 2430

Note: The above information may be inaccurate. Investors should not use this as a basis for deciding to place a trade.